The Austrian Business Cycle Debunked

More on why I am not an Austrian. Austrian Economics is not consistent with Objectivism and it is not correct formulation of Economics Science.

| You type: | You see: |

|---|---|

| *italics* | italics |

| **bold** | bold |

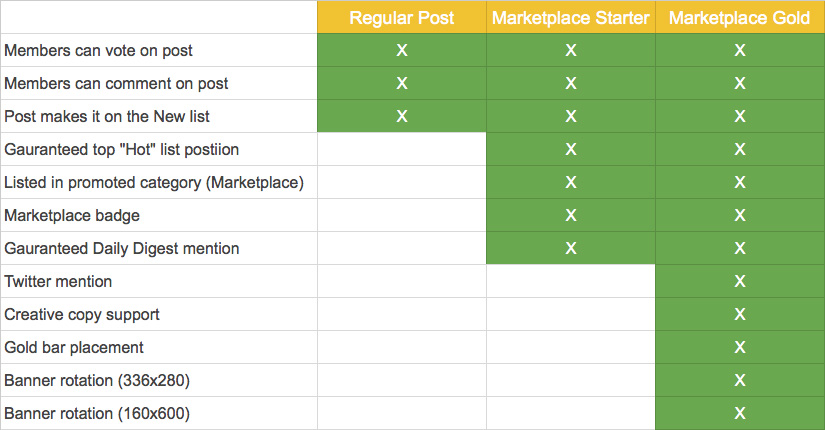

While we're very happy to have you in the Gulch and appreciate your wanting to fully engage, some things in the Gulch (e.g. voting, links in comments) are a privilege, not a right. To get you up to speed as quickly as possible, we've provided two options for earning these privileges.

1) You state that "savers" have alternate means of saving, such as investing in stocks and corporate bonds. The Austrian School says that savings provide the stored capital to invest. Those alternatives just provide a different route to that investment. Stocks either do so by providing money directly to a company (if the shares are via an IPO or from the store that the company retains and sells on the open market), or indirectly via sales that garner revenue for another party that are then put into banked savings, more stock purchases (which then starts the cycle again), bonds, or consumption. Bonds on the other hand are direct investment, as they are sold by companies to fund operations and improvements/expansion. Thus, even those alternate mechanisms for "saving" really lead to investment, which is the premise of the Austrian School's evaluation of the business cycle.

2) If you truly think that stock price is dependent on company performance, then you are more ignorant of the stock market than I thought.

3) You state that Austrians aren't concerned with interest rates that are "too high." That is not true. It is merely that that occurs less frequently than them being too low. Nor are central banks (the Fed) likely to retain high interest rates, but they often set them and maintain them too low. Too low of interest rates encourage mal-investment by encouraging money into activities that otherwise wouldn't be funded as too risky. But, since the rates are so low, the bankers are looking for anything that will give them a chance at a better return. They take a chance knowing that the money that they are lending is garnering them no return sitting idle, so any opportunity to improve that outcome is pursued. Higher interest rates discourage loan seekers for less risky investments, as they have increased costs and their level of return must be higher to make a viable financial proposal.

4) You cite that central banks are relatively new phenomenon. That in itself is true. But the control of currency has been the case since currency has existed, in any form it has existed. When that control has been centralized, via a government usually, it is subject to manipulation, and it is the manipulation that is the issue, not specifically who does the manipulation. As far back as the Romans (and further) coinage was manipulated so as to inflate the value. Other lower cost alloys were used so as to debase the value of the metal (our current coinage has undergone the same debasement), as has shrinking the size of the coinage so as to reduce the amount of precious metal included in the coin. All of these things cause inflation of the currency, whether it is caused by a central bank or not is irrelevant.

5) Inflation and recession are also functions of government spending, particularly during wars when governments often expand the money supply to fund the war. This spending causes a distortion in the economy similar to the mal-investment of low interest rates. Businesses that otherwise would not receive funding do, despite the risks. While this is not specifically called out by the Austrian Business Cycle, it is in the same vein of causal effect.

These are just 5 glaring issues in your analysis. I don't have time to continue on, but anyone reading your essay should place these comments in context and evaluate the Austrian School and the Business Cycle appropriately.

You continue to demean the Austrians because, in my evaluation, some Austrians do not support your view of Intellectual Property rights. You skew their principles based on this view, and present a jaded perspective.

A hypothesis: any central bank action makes recession more likely.

Quantitative easing translates to investment (Mal-investment to be sure :)

If the FED was not able to print money (based on buying treasuries) and interest rates were market based THEN savings would correlate with investment.

Technology and increases in production due to technology is the only source of growth. The constant theft of the government (which appears as price inflation but is really the Deflation of the value of the currency hence prices must adjust upwards) is hidden by the deflation of prices due to technology. That's the only reason the government can get away with it and not kill the economy.

In the end everyone could have been 100 times richer, and the economy much larger, if the government didn't take it all.

Great article- thanks

Amen, we can be all friends again now.

The 'differentiate' list is v. useful.

On the section "The O meta-ethics and ethics do not need to bought into .." I think this says that Objectivism provides a theoretical framework on which economic policies can be evaluated, and, if that first step is wrong, with inadequate foundations of logic and ethics, then so will be derivations into economics and politics.

There is a lot of marking up and down here.

If many of the markers are austrian economics supporters, could more thought out argument be given as well as down points please? Or, it could be that dbhalling's confrontational style builds resistance. Unfortunate as his inputs are very constructive.

I noticed that many Austrians seemed to be religious and I wondered why this was, so I started investigating. Von Mises was an atheist but more in the way Marx is an atheist than Rand. I found David Kelley's paper on Rand v. Hayek and it is clear that Hayek is talking about the fundamental limits of reason. He is clear that he thinks Locke's natural rights is not based in reason and cannot be based in reason, it is based on some sort of cultural evolution, which by the way makes him a moral relativist. I then investigated Von Mises and his idea that prices were subjective.. I use to make this argument myself, but it always bothered me because even the best interpretation turns economics into a game with little or no connection to reality. But Mises was not and is not saying prices and values are determined by each individual, he is saying they are not connected to reality.

The reason Austrians attract religious people like Robbie is because the philosophical foundations are consistent with religion not with science - which makes them more like the socialists (post modernist movement) than objectivists or Locke or the enlightenment. Rand used to warn that capitalisms defenders were worse than its enemies and I put the Austrian squarely in that camp.

The 2001 recession was caused by the Fed, but not because they printed too much money. The 2008 recession was not caused by the Fed, it had many causes of which poor lending practices was one, but hardly the only one.

My goal is not to build a coalition or politics, like you and Keith Werner. My goal is to get people to think. We have had years of pundits in the US pushing pro “free market” positions, but like Rand said Capitalisms defenders are often its worst enemies, including the Austrians.

(original quote used 'laid', not 'placed,' but....)

Herb, I'd say you're more of a 'normal today consumer.' In our childhood, many of us loved to understand How and Why things worked.

There was a time when I could describe pretty much How and Why EVERY part of an automobile, from bumper to bumper and ALL systems and components, worked, and why (except maybe torque converters...).

Today, I describe my personal car, my Prius, as a Computer on Wheels. There is NO physical connection between the gas pedal and the engine. The gas pedal has a magnetic sensor (Hall Effect chip) that senses the position of the pedal and sends a signal to a computer where algorithms compare tons of things about the car in order to decide whether to use the engine, battery or some combination, as well as how much throttle opening to set (if any) and how much fuel to inject.

With no physical cable or lever between your foot and the power plant in the front of the car.

But without all that gingerbread, the Automobile System I drive could not meet fuel economy and pollution standards demanded today (by the government, actually.)

Think about the early autos. They were Dead Simple... totally NOT 'complex,' per se. You had to start them by hand with a crank. Much simpler than all the ancillary stuff a 'starter motor' adds to the car, but the starter motor saved a lot of broken wrists and consumers preferred that.

Please differentiate between 'simple' and 'easy.'

Today's cars are Far From Simple, but Way Easy for everyone.

:) And I still miss my old Corvette, even with all of its problems and shortcomings.

I understand and appreciate the emphasis and examination you have done exposing the problems with some of the foundations of Austrian economics. If I am understanding correctly, the Austrians, despite their condemnation of socialist and etatistic economic models, are poor spokespersons for capitalism due to vulnerability of their underlying, supporting premises. Those that are inclined to examine the underlying problems would see holes that could be exploited, thus providing openings for socialists to exploit.

Despite the problems with Austrians, as you have related, I have always felt they were common warriors for free markets and more aligned with desirable policies in regards to capitalism than most other schools of economics. My thoughts have been that their arguments were not always the best, but supplementary... complimentary... that outcome, by convincing more people by whatever arguments are persuasive to their sensibilities was still of some benefit. However, if these weak arguments are to be turned against capitalism...

Though it is my intention to acquire and read your book, in the mean, could you recommend another school of economics that is less objectionable? Please list a few of the economists that you find most congruent with objectivist economic philosophy aside from Rand.

Respectfully,

O.A.

The short answer is no. I embarked on such a quest about 10 years ago. A book on economics that really got me thinking was called, Farewell to Alms. I did not agree with the book, but it got me to start looking at economic history over a much longer time frame and somewhere around then is when I first heard an economist say that all real per capita growth is the result of technology. Paul Romer does a good job of making this point, but then goes off the ranch on property rights including patents. (There is a good article with him in Reason Magazine - online) His is a mathematical Keynesian and tries to preserve Perfect Competition. I spend a fair amount of time explaining his positions in my book.

A great book on the economics of invention is, Inventions and Economic Growth, by Jacob Schmookler an economist. Unfortunately, it is out of print. I got a second hand copy. He makes the point that classical and neo-classic economic is fine for a technologically stagnant world, but all the interesting things happen in economics because the world is not technologically stagnant. He does not express any real points about economic freedom per se, his book is an econometric study of inventions.

There are some other books that are great. One of them is called, The Most Powerful Idea in the World. Very readable with a good account about the beginning of the Industrial Revolution, but too biased toward Great Britain. Again he is not making any broad points about freedom.

There are some other good books on point, including one by the economist Zorina Khan, but her book is pretty dry and again no real points about freedom, it is about patents and inventions and from a historical point of view in the United States.

I think this area of economics presents a huge opportunity for Objectivists to make their mark on economics and provide a science of economics that is consistent with Objectivism. My talk at Atlas Society will focus on this point. My book makes the arguments without any reference to Objectivism.

Well then...looking forward to your book. You may be aware from a previous post, that I am reading L. Von Mises Socialism... so far the subject matter of this particular book does not enter into areas of which you have raised objections excepting one. That is the Malthus Theory of Population. Here I find Mises seems a bit too sympathetic and I must remind myself that the book was first written in 1922 and grant a bit of allowance. Otherwise it is proving to be a most lengthy, boring and difficult read, but it has no equal in breaking down every favorable, conceivable argument for state control while supporting private ownership.

Respectfully,

O.A.

On the face of it, Austrian Economic makes sense from the point of view of multiple incentives inspiring action. There's something missing from that because those incentives don't always work.

I would add this to either theory, attitude and motivation. I think it doesn't matter much which theory you subscribe to, if the attitude of the masses is fear based, there will be little expansion. On the other hand when the measurement of confidence is high, millions of people decide to do things they have been putting off until better times. A good portion of the things put off are big ticket items like cars, houses, RVs, cruises, etc. This change in attitude puts a forward bias on the economy no matter what theory or metric we use to measure it.

I have noticed in the last few months the news people have been publicizing the consumer confidence stats. They are up from the last 5 years, slightly. My theory, the Ronc grow your own gulch theory, says that when confidence is down is a good time to expand as there is little competition. Then when confidence is renewed it is a good time to sell these opportunities to those who now have the ability and willingness to buy. That is very mercenary, but that's how it works in my micro. Buy low, Sell high. My personal economy grows this way, and I submit that if multiply that by 3 or 4 billion there will be ups and downs based on the experiences and confidence of the masses.

At it's worst, technology is a job killer. When productivity goes up so much 6 or 10 people can do the job 150 used to do, it's difficult for people and ultimately society to reallocate and re-educate that labor force. That happened at the main Post Office when they automated. A workforce of about 4000 is now replaced by about 150 people. And, the service is just about the same. Remember, the "Last" word in our name is Service! United States Postal Service.

Economics is a science; it is the science of human action. It is not a "hard" science like math or physics that can be proven by future testers conducting the same experiment and observing identical results. The variable in economics is the human element; one of the tenants of economics is that people behave rationally. The problem with that is that some people do not act rationally at all times, therefore, the results of observations may vary with different people under their current circumstances.

I support the ABCT and see no errors in it. Austrians, like any other group of thinkers, will have differing views on property rights and IP, but they almost all fully agree on the concept of factional reserve banking, especially when orchestrated by a central bank, is the root cause of the business cycle. If the money supply is not manipulated, the business cycle would not exist!

ABCT is wrong about the source of economic growth - it does not matter whether you see it, it is a fact. They are wrong about Central Banks causing all recessions. They are wrong in equating fractional reserve banking with central banks and with creating money out of thin air.

Austrian Economics is not a science. It rejects the fundamental tenants for all sciences - an objective reality and that reason is capable of understand the world.